nj tax sale certificate redemption

Office of the County Clerk. Redemption is made at the office of the tax collector unless otherwise directed.

Beach Haven NJ 08008 Phone.

. 609-492-1109 taxofficebeachhaven-njgov Tax Sale Certificate Redemption Request Form FIGURES MAY CHANGE WITHOUT NOTICE PAYMENT OF LIENS MUST BE BY CERTIFIED FUNDS OR CASH EMAIL OR FAX TO EMAIL ADDRESS OR FAX NUMBER ABOVE THERE IS A 3-DAY TURN. Redemption of tax sale certificates TSCs can present difficulties for buyers and sellers as well as for their attorneys and title companies. Or 2 remedies the conditions in.

If redemption is made after the filing of the complaint redemption is made as to the subject parcel only presuming that notice was filed in the tax collectors office and is subject to the fixing of fees and costs. New Brunswick NJ 08901. Once a lien has been placed on a parcel the only persons able to redeem that lien are.

The city would auction off that debt and a tax sale certificate would be issued. But if at the sale a person offers a rate of interest less than 1 or at no interest that person may instead of an interest rate offer a premium over the tax amount. The property owner continues to have the right to redeem the tax sale certificate up until date of the final judgment.

Sales and Use Tax. New Jersey Tax Lien Auctions. These payments are added to the tax sale certificate provided affidavits are filed pursuant to NJSA 545-61.

Certificate of Exempt Capital Improvement. Nj tax sale certificate redemption. If the certificate is redeemed after a foreclosure action has been commenced the property owner should file an Affidavit of Redemption and the foreclosure action will be dismissed by entry of an Order.

A provision of the urban redevelopment act provides that in the event of a tax foreclosure of a property on the abandoned property list redemption is not permitted unless the owner either 1 posts cash or a bond equal to the cost of remediating the conditions which led to the property being placed on the list. In the absence of a timely redemption the tax sale certificate holder will obtain title to the property upon receiving a final judgment in foreclosure. So now there could be a tax sale certificate sale that would place a lien on the house because of a previously held New Jersey Tax Sale Certificate Auction.

A certificate of redemption is an official acknowledgment that a property owner has paid off in full all delinquent property taxes penalties fees and. New Jersey is a good state for tax lien certificate sales. This is your permit to collect Sales Tax and to use Sales Tax exemption certificates.

The accelerated tax sale. Name of the tax. 18 or more depending on penalties.

Types of Tax Sale. They include the owners trustees for the owners heirs of the owners holder of any prior tax sale certificates mortgagees and any legal occupant. The owner hisher heirs the holder of a prior open tax certificate mortgage holder or legal.

These payments are added to the tax sale certificate. Title practice 10117 4th ed. There are 2 types of tax sales in New Jersey.

The process was made more complex as a result of the decisions of the New Jersey Supreme Court in Simon v. New Jersey 08210-5000 Tax Sale Certificate Redemption Purpose The purpose is to discharge an original Tax Sale Certificate. Sales and Use Tax.

Standard tax saleis held within the current year for delinquent taxes of the prior year. The issuance of the tax sale certificate set the amount the property owner could pay to redeem the certificate and under New Jersey tax law this redemption amount accrued interest at a rate of 18 percent. 30 rows Urban Enterprise Zone Sales Tax Collection Schedule 35 ended on 12312016.

If the certificate is redeemed by the property owner prior to foreclosure the certificate earns a redemption penalty at the rate of 2 4 or 6 percent depending on the amount of the. A cover sheet or electronic synopsis. The property owner did not redeem the certificate and after two years the purchaser initiated a tax lien foreclosure action.

As a seller of taxable goods or services you are required to be registered with the New Jersey Division of Revenue and Enterprise Services. Here is a summary of information for tax sales in New Jersey. Tax Sale Certificate Redemption Redemption.

So in the above case we can pretend 10000 in taxes were due to the city. Redemption is governed by statute Only certain enumerated persons with interests in a property may redeem the Tax Sale Certificate. If the tax lien certificate is redeemed by the delinquent property owner prior to foreclosure the tax lien certificate earns a redemption penalty at the rate of 2 4 or 6 percent depending on the amount of the original tax lien certificate in addition to any interest rate on the certificate.

Title Practice 10117 4th Ed. According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is. The fill in cover sheet form is available at this link.

Redeeming Tax Sale Certificates Redemption. The property owner has a limited amount of time to pay or redeem the tax sale certificate. Sales and Use Tax.

Is held prior to the end of the year for that years tax delinquenciesThe Township of Cranford does not hold accelerated tax sales only standard sales of the. Once registered you must display your Certificate of Authority for Sales Tax Form CA-1 at your business location. Requirements NJSA 4626A NJSA 545 1.

Redeeming Tax Sale Certificates Once a lien has been placed on a parcel the only persons able to redeem that lien are the owner hisher heirs the holder or a prior outstanding tax lien certificate mortgage or legal occupant of property sold at a tax sale and they may only redeem until the right to redeem has been cut off. In this particular situation the tax sale holder claims to have paid the taxes for 27 consecutive years but did not file a foreclosure suit. If the certificate is redeemed by the property owner prior to foreclosure the certificate earns a redemption penalty at the rate of 2 4 or 6 percent.

Urban Enterprise Zone Sales Tax. Up to 25 cash back Again in a New Jersey tax sale the property is sold at a public auction subject to the right of redemption to the person who offers the lowest interest rate on the tax debt which cant exceed 18. 2016 discusses issues relating to the redemption of TSCs.

Dates of sales vary depending on the municipality. In new jersey the length of the redemption period depends on whether a third party bought the lien at the sale and whether the home is vacant. Elements of Tax Sales in New Jersey New Jersey law requires all 566 municipalities to hold at least one tax sale per year if the municipality has delinquent.

The Official Website Of City Of Union City Nj Tax Department

Tax Certificate And Tax Deed Sales Pinellas County Tax

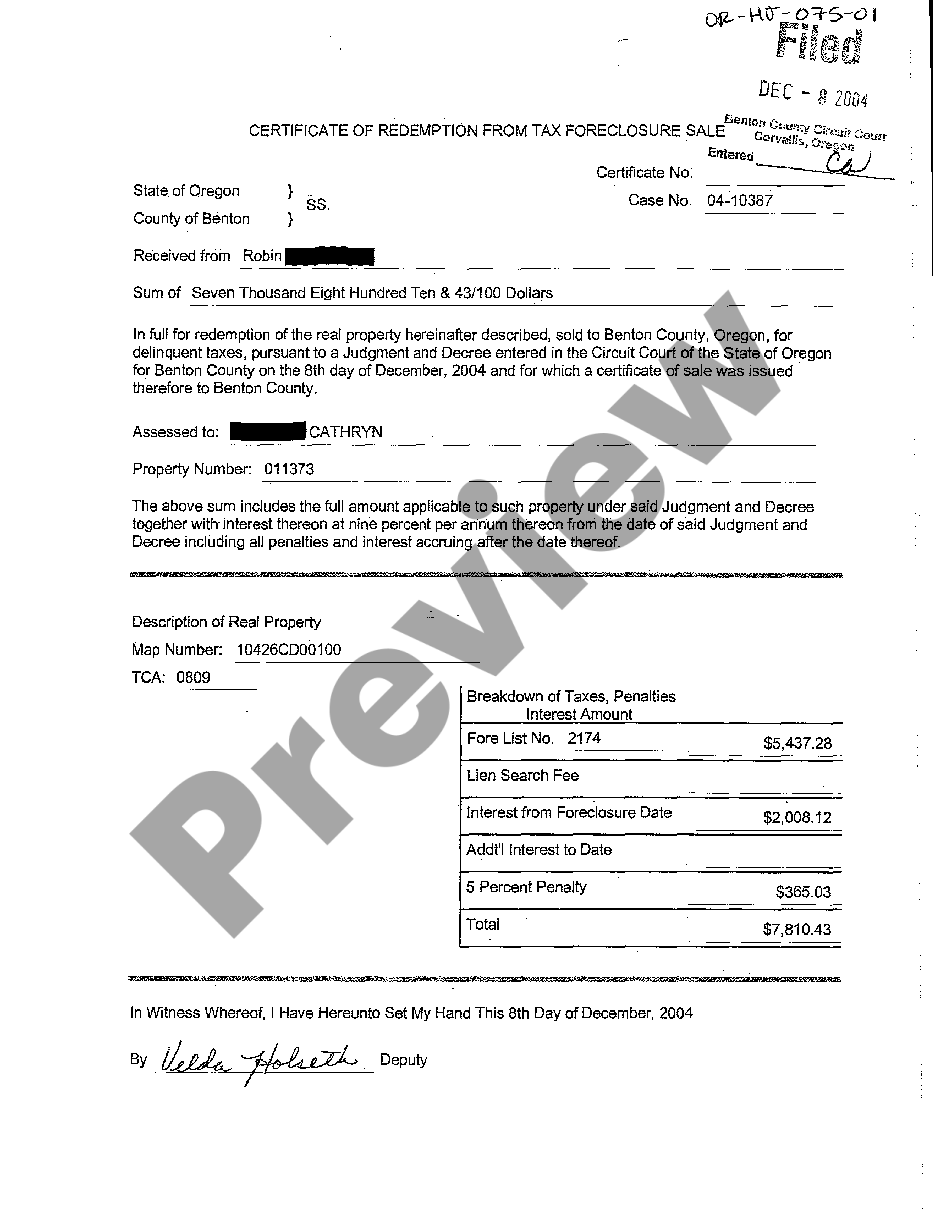

Oregon Certificate Of Redemption From Tax Foreclosure Sale Us Legal Forms

California 2009 Treasury Warrant California Numismatics Society